Electric Vehicles Pay Their Fair Share

March 10, 2017 | Dane McFarlane | Education

Recent tax policy analysis by the Great Plains Institute for Drive Electric Minnesota found that electric cars pay just as much or more taxes as comparable gasoline vehicles.

Like most other states, Minnesota uses a tax on the sale of gasoline and other motor fuel to pay for transportation infrastructure like highways and bridges, among other uses. This excise tax is paid by the consumer at the pump at a rate of 28.5 cents per gallon ($0.285 / gal), which means that the more one drives, the more taxes one will pay through the consumption of additional fuel. Since more driving causes more wear and damage to public driving infrastructure, this makes sense. This also means, however, that plug-in electric vehicles (EVs) do not pay any motor fuel excise tax.

Recent discussions surrounding 2017 Minnesota legislative policy have called into question whether electric vehicles are paying their fair share for driving on the same roads and bridges as gasoline and diesel vehicles. So, are they? Recent analysis by Drive Electric Minnesota looked at the combination of taxes paid by all vehicles and found that EV owners usually pay just as much or more state vehicle taxes as their fossil fuel counterparts.

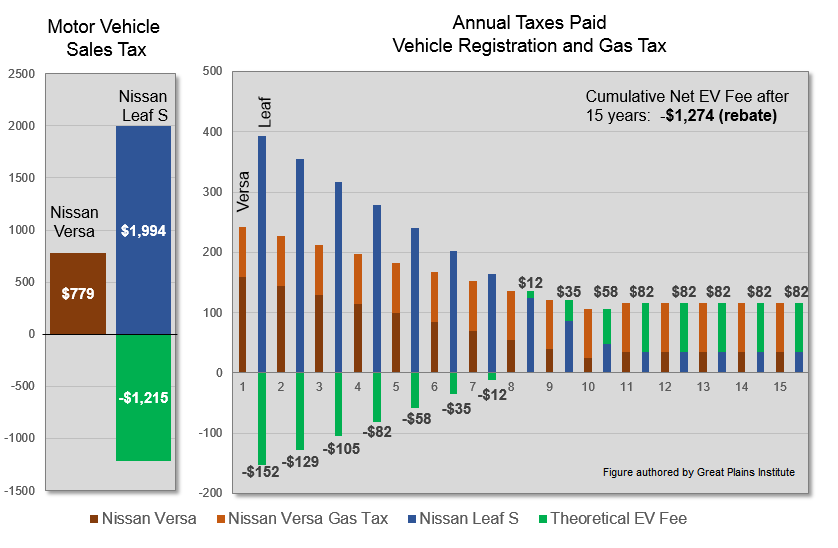

There are three primary taxes paid by vehicle owners in Minnesota: the Motor Vehicle Sales Tax (MVST), annual motor vehicle registration taxes, and the motor fuel excise tax (gas tax). These three taxes are constitutionally dedicated to be “used solely for highway purposes”. Although the motor fuel tax is the largest funding source of the three, it represents only 45% of the total funding. Two of these taxes, the MVST and registration taxes, are based on the retail value of the vehicle, which is often much higher for EVs than for conventional automobiles.

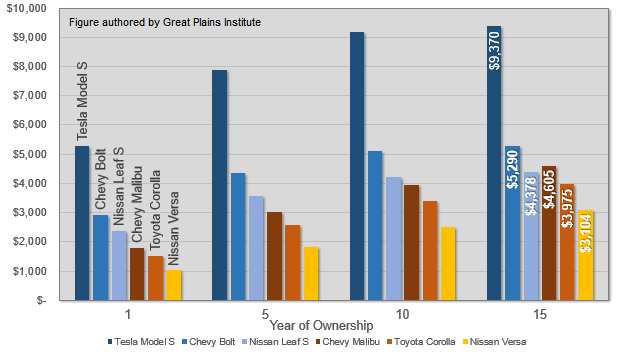

In an analysis of typical 2017 models for both gasoline and electric cars, Drive Electric MN found that the total amount paid by EV owners through the MVST and annual registration fees more than makes up for any loss of government revenue from the lack of gasoline fill-ups.

At a rate of 6.5% of sales price for the MVST and 1.25% of vehicle value for the registration tax, models with higher sticker prices will pay more taxes. The annual registration tax applies a 10% discount to the vehicle value each year, until finally in year 11 all vehicles (both gasoline and electric) pay a flat $35 fee. Gasoline cars that drive 10,000 miles per year at 30 miles-per-gallon will pay about $95 in gas taxes each year.

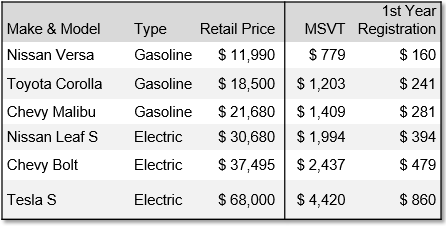

As shown in the table above, a typical electric car is significantly more expensive than a comparable conventional automobile. A base model Nissan Leaf S costs $30,680 compared to the Nissan Versa at $11,990, while a base model Chevy Bolt costs $37,495 compared to the Chevy Malibu at $21,680. So, while the conventional cars pay about $80-100 in gas taxes each year, EVs generally pay much more based on their sales price and vehicle value. Even though EV buyers can benefit from a federal tax credit, and some EVs come with manufacturer incentives, taxes are still calculated based on the retail price and does not reflect those cost reductions.

Some groups and legislators have suggested an additional “EV Fee” that EV owners should pay to make up for any loss of revenue from not paying the gasoline tax. However, Drive Electric MN’s analysis shows that EVs already pay their fair share through the Motor Vehicle Sales Tax and annual registration fees. Drive Electric MN took a look at what a theoretical EV Fee would look like if it was calculated as the difference between taxes paid by an EV and a conventional automobile. For the first 10 years, the state would actually need to pay EV owners a rebate based on the additional sales and registration taxes they are required to pay.

As shown in the chart above, it is only after 10 years, when both EVs and gasoline cars pay a flat $35 registration fee each year, that owners of conventional automobiles pay more due to the gasoline tax. And even then, the cumulative taxes paid by an EV owner are usually greater.

EVs are a new technology, and their retail prices are higher than a comparable conventional vehicle because automotive lithium batteries are still traveling a technology learning curve. This is why the average EV costs $36,644 while the average compact car costs only $20,237, and the average midsize car costs $25,095 (Kelly Blue Book, as of March 2016). Over time, the cost of EVs will decline as EV battery costs decline. Bloomberg New Energy Finance and McKinsey both estimate the EVs will achieve cost-parity with conventional vehicles (without tax credits) by 2025-2030. When that happens, EVs will no longer pay higher than average sales and registration taxes. Right now, however, EVs are already paying their fair share.

The Great Plains Institute (GPI) leads Drive Electric Minnesota and is a non-partisan non-profit organization that uses consensus-based strategies to discover and implement politically durable solutions to society’s most pressing energy and climate challenges. Learn more at www.betterenergy.org.